We all know that banking apps have revolutionized the way we manage our finances, making it easier and more convenient than ever before to keep track of our money. However, with new Fintech apps releasing every week, it can be hard to know which one is right for you. Whether you are new to banking and need a first bank account or a banking veteran who has 10 different checking accounts, we’ve put together a list of the top three banking apps based on how well they work on iOS, so you can choose which best suits your needs. I have personally been a user of all three of these institutions and currently use one of them as my main form of banking. We’ll be provide detailed reviews of each app, including features, pricing, customer service, and more.

Table of contents

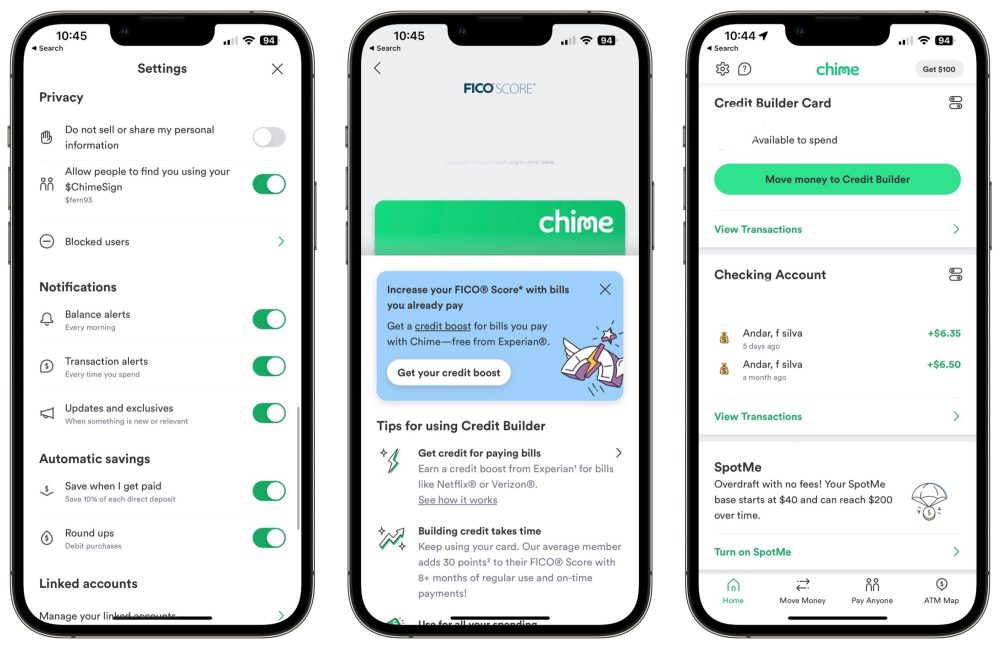

Best banking app for beginners – Chime Bank

Although I no longer use Chime as my main bank, it will forever have a special place in my heart, and I still actively recommend it to anyone that needs a no-frills bank account. I used Chime bank for over five years before finally moving on (I will explain why at the end). Chime helped instill what it meant to be financially responsible with its products and features. It taught me about long-term saving, credit building, managing my bills, and so much more.

Chime bank offers an array of benefits that make it the perfect choice for beginners. It is completely free to open an account, and there are no hidden fees or charges. The online banking app is incredibly user-friendly and easy to navigate, allowing users to easily manage their finances. Chime bank also offers a fantastic credit builder program, allowing users to build their credit without racking up any debt by pre-paying a credit card that gets automatically paid for on time. Plus, its expansive network of free ATMs makes managing finances easier by eliminating the need to pay ATM fees. With all of these features, Chime bank is the ideal choice for anyone looking to start their banking journey.

Pros

- Extremely user-friendly, 4.8 stars on app store

- Chime Credit Builder program – free credit card to help build your credit

- Get paid two days early

- ZERO fees, no transaction fees, late fees, overdraft fees, or monthly fees of any kind

- Spot Me service for overdraft protection up to $200

- Automated savings feature – Round up savings and automated paycheck division

- Disable lost or stolen card

- View card info digitally

- Offers Checking & Savings accounts with 2% APY as of Feb 2023

- Uses Visa network

- Mobile check deposit

- Free Credit Score

Cons

- No physical branches – if you are someone that likes to go into a bank, then this is not for you

- Mobile check deposit is only available if enrolled in direct deposit

- Not very feature rich. No investment platform, loan products, insurance platform, or mortgage offerings

- No cashier checks

Who Chime is for?

Chime can be for anyone depending on your situation. For instance, I chose Chime because I loved the user experience, and it was one of the first banks to offer these “fee-less” banking options with no physical footprint. I needed something reliable that I could access from my phone and take in direct deposits. As Chime evolved, I signed up for their Credit Builder which raised my credit score by 45 points in a year’s time by showing a history of paying on time. This is great for someone coming into the workforce and needing something that is easy to use, helps build credit, and assists with the fundamentals of saving.

Give it a shot if this is the type of bank you are looking for. They are currently offering $100 to anyone that signs up and links their direct deposit (free money)!

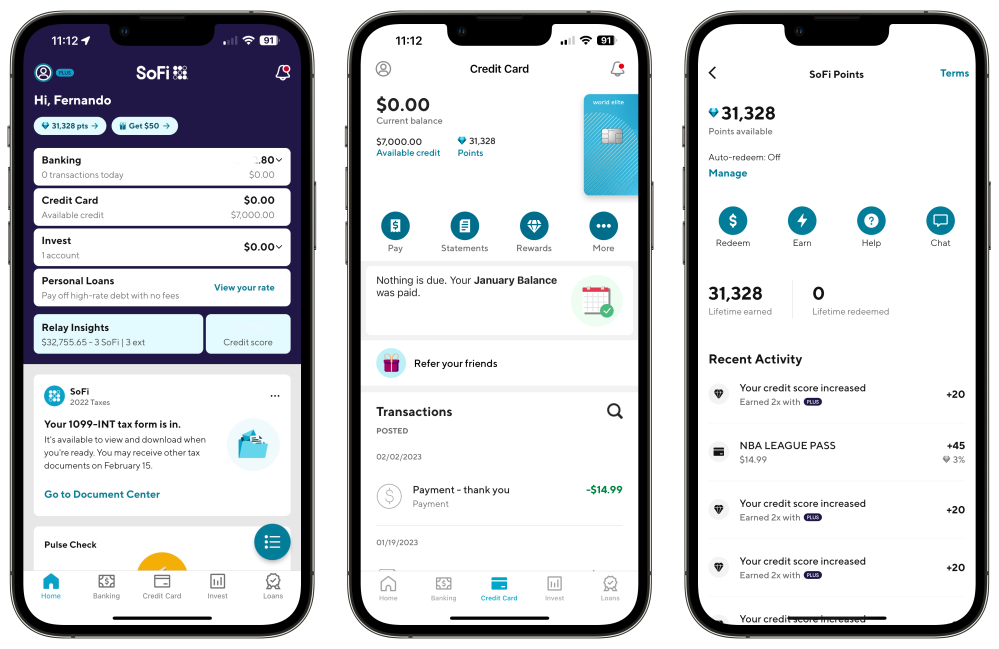

Best all-in-one banking app – Sofi Bank

If Chime bank is the bank for beginners, then Sofi is the next level up. I have been a Sofi bank user for a year now, and it’s been a great transition. It follows a lot of the same principles that Chime bank has like zero fees, getting paid two days early, and no brick-and-mortar branches. Sofi Bank is the best bank for anyone looking for a modern banking experience that provides most of your financial product service needs.

The reason I switched to Sofi was that I wanted a bit more out of my banking experience than what Chime was offering. Chime was there to teach me how to bank and manage my money, while Sofi is here to help with all of my financial goals – not just banking.

Sofi Bank offers a range of products, from personal checking and high-yield savings accounts (3.75% APY since Feb 2023) to mortgage loans to Roth IRAs, investing, credit cards, and even retirement planning. They also provide a great way to help save for certain goals with their Vaults system. You can designate a dollar or percentage amount of each deposit to go towards a rainy day fund (or a home, or a vacation). Their credit card is actually a great beginner card. Great approval odds, falls in the Mastercard Elite program, gives you 3% cash back on every single thing you buy for the first year and then drops to 2%, and, lastly, it works with Apple Pay.

Sofi Bank also provides a mobile app that is convenient, secure, and easy to use. With these features, Sofi Bank stands out as the premier option for anyone looking for a modern and reliable banking experience.

Pros

- Feature-rich & easy-to-use interface, 4.8 stars on the app store

- An abundance of financial products

- High-yield savings account – 3.75% APY

- Vaults – used to automatically save for certain things

- ZERO fees, no transaction fees, late fees, overdraft fees, or monthly fees of any kind

- Paycheck two days early

- Investing platforms

- Retirement planning

- ATM network of 60,000 ATMs

- Mobile check deposit

- Great, zero-fee, beginner credit card with 3% cash back

- Apple Pay support

- Mastercard network

- Offering $50 for new sign-ups!

- Free Credit Score

Cons

- No physical bank branches

- $4.95 fee to deposit cash

- No cashier checks

Who Sofi is for?

Sofi is for the banking customer that is ready to take a bit of a step up in their banking journey. It has an amazing iPhone app that is easy to use and intuitive to understand; it offers a wide variety of banking products and services, but does it in an efficient and simple way so its not overwhelming. Sofi is for anyone looking to have a great mobile banking experience, that doesn’t care about physical branches, who wants a high-yield savings account, and wants the option to venture into other financial products like investing, credit cards, and more.

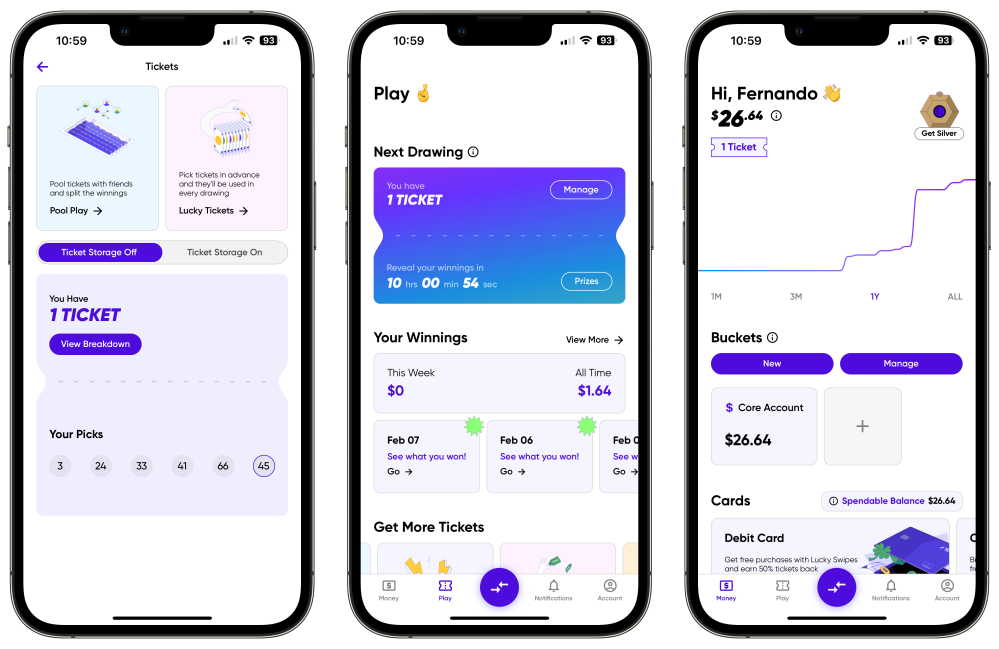

Best bank for gamification – Yotta Bank

Yotta Bank tries to take a different approach to traditional banking; their slogan is “Banking for Winners.” They seem to have found a solution to make banking and saving money “fun” by introducing a gamification aspect. This bank is also a mobile-first banking experience, so it still has the same zero maintenance fees, no overdraft fees, checking & saving accounts, and a large ATM network.

Yotta Bank gamification of saving money

What sets Yotta bank apart is how they handle the savings and APY aspects of banking. Instead of giving us a fixed rate APY savings percentage, they take a zero-risk lottery approach to saving money. For every $25 in your Yotta bank account, you get one “lottery ticket.” So if you have $100 in your account, you get four tickets. Every day at 9 p.m. EST, they do a lottery draw, and depending on your ticket you could win nothing or win some insane prizes like $1,000,000 or a new Tesla. These lottery tickets are technically what your APY is; Yotta says that on average people see a 2.7% APY on their money. It technically costs nothing to enter the lottery, you just bank normally and the more money in your account, the more tickets you get, and the higher the chance to win big are.

I have been a Yotta member for about nine months now, and I use it as a secondary savings account, and in those nine months, I have seen a 3.1% return with the APY, which is great. It’s a fun way to still have a safe savings account that earns interest but also has a chance to win you a hefty payday. Every night at 9 p.m., I check to see if i “won the lottery,” and it encourages good savings habits by increasing your chances of winning.

Pros

- A fun way of incentivizing savings

- 2.7% APY savings

- ZERO fees, no transaction fees, late fees, overdraft fees, or monthly fees of any kind

- two-day early payday

- Chance to win $1,000,000 every day

- Debit card that offers more chances to win

- Mastercard network

- Checking and savings accounts

- 55,000 ATM network

Cons

- No physical branches; if you are someone that likes to go into a bank, then this is not for you

- Technically, the APY is variable

- Only offers checking, savings debit, and credit card, no other financial services

- Can be a bit overwhelming if you are not aware of the Yotta lottery system

Who is Yotta Bank for?

Yotta bank is a bank with an extremely unique offering. If you enjoy actively banking, seeing your savings go up, and are a fan of lottery systems then this is the bank for you. At the end of the day, Yotta is just paying you an above-average APY on your money, but they make it much more engaging and fun. There are testimonials of people winning $10k, $20k, or even more; it’s not crazy to think you could be one of those winners.

I personally use it as a backup savings account, because it is fun to be a part of this world. In my opinion, it’s a free way to increase your savings and play Yotta’s version of the lottery. It’s free to sign up, so I would recommend this to pretty much anyone. Whether you need a primary bank or just want a backup, this could be a fun way to get your savings numbers up!

Wrap-up

At the end of the day, it’s tough to go wrong with any of these mobile banking platforms. Chime was great for me for years before I went to Sofi. Sofi has been amazing for all of my new financial needs like having a credit card, planning for retirement, and opening investment accounts. Then, Yotta bank is a fun way of engaging and interacting with your financial goals. All of these will help you along your financial journey – they are simple to use, offer unmatched value, and ultimately help build a positive relationship with your money.

FTC: We use income earning auto affiliate links. More.