Originally published on June 1, this story has since been updated with a statement from a Goldman Sachs representative.

Apple’s new high-yield savings account service recently launched with a positive reception, especially over how easy it is to set up. A new report from the Wall Street Journal, however, says some customers claim getting money is out a different story.

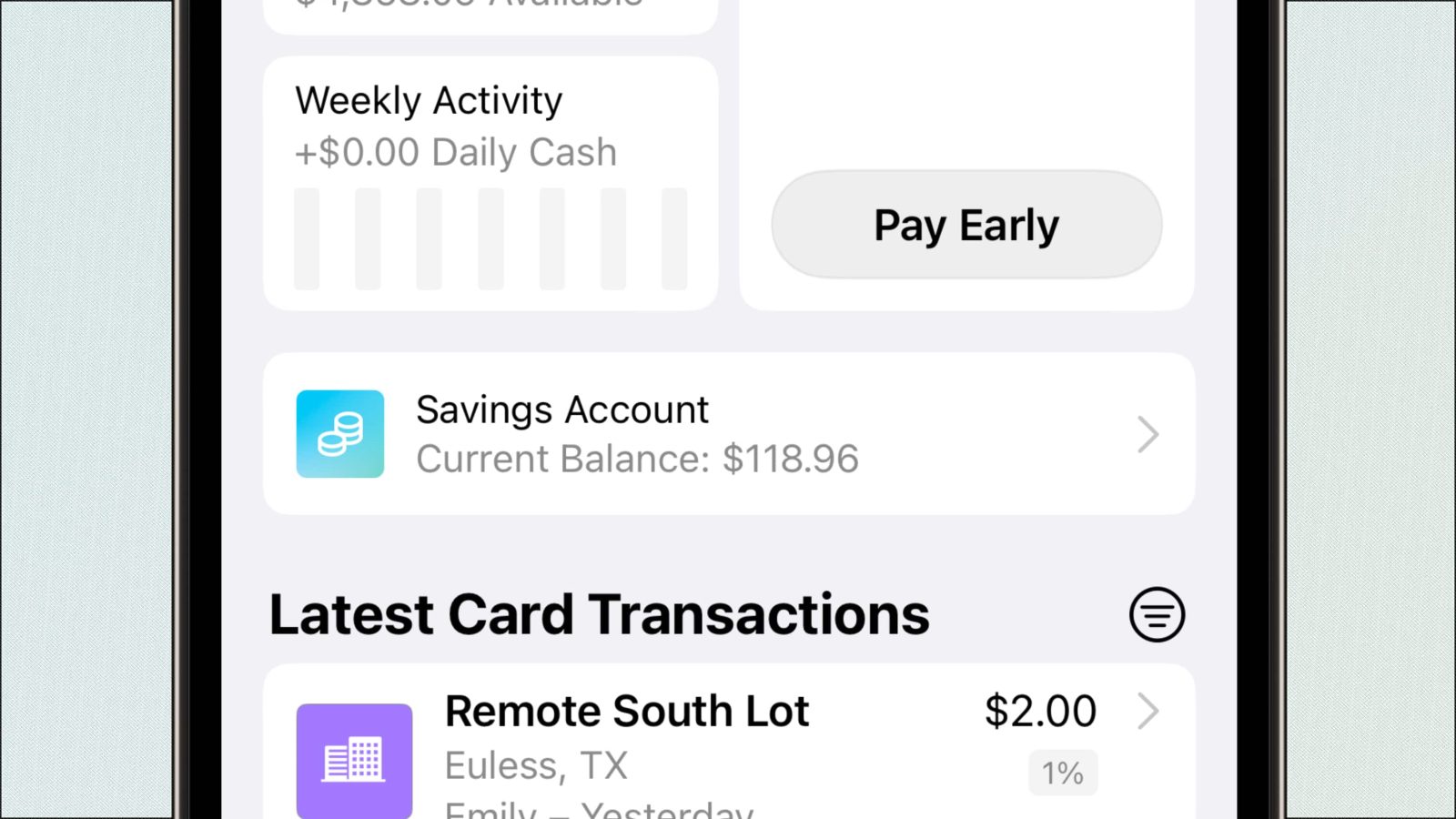

Apple’s savings account service is part of Apple Card, the Apple-branded credit card that’s managed on the iPhone and backed by Goldman Sachs. Goldman Sachs is also the banking partner for Apple savings accounts.

According to WSJ, a number of customers have experienced weeks-long delays when trying to transfer money from an Apple savings account to an external bank account. Others have reported receiving different instructions for how to facilitate a transfer for different banks. In some cases, money has appeared to vanish between transfers with a balance not available in either the savings account or bank account. Yikes.

At least one customer has opted to close the Apple savings account over these hiccups:

Kevin Smyth of Minnesota tried transferring $10,000 from his Apple account to U.S. Bank on May 16. He needed the money to pay for remodeling his basement. Goldman told him to contact U.S. Bank, Smyth said. U.S. Bank told him it saw no sign of an incoming transaction, he said.

Smyth said Goldman eventually told him that his account was under a security review. Smyth tweeted at Apple Chief Executive Tim Cook on May 25. “Was your plan to partner with a bank that holds people’s life savings hostage?” he wrote.

Goldman later told Smyth he would have to transfer the $10,000 to American Express, which is where the money had been.

Smyth went a step further. He emptied his Apple account, moving all $200,000 back to Amex. The money showed up promptly.

While the piece does not include a comment from Apple, the bank behind Apple Card and its saving accounts puts some blame on these accounts being new and large transfers requiring more scrutiny for security purposes.

A competitively high-interest rate for Apple’s savings accounts hasn’t been the only thing luring customers to consider doing business with the company.

Apple also makes the process of applying for the savings account and transferring money to the savings account extremely simple and accessible. Rather than going to a bank or completing an application online, the process simply requires tapping a few buttons in the iPhone’s Wallet app.

Within the first four days of launching, Apple reportedly saw $1 billion transferred into the new savings accounts.

In response to the story, a representative from Goldman Sachs shared this statement with 9to5Mac:

“The customer response to the new Savings account for Apple Card users has been excellent and beyond our expectations. While the vast majority of customers see no delays in transferring their funds, in a limited number of cases, a user may experience a delayed transfer due to processes in place designed to help protect their accounts. While we would not comment on specific customer interactions, we take our obligation to protect our customers deposits very seriously and work to create a balance between a seamless customer experience and that protection.”

Add 9to5Mac to your Google News feed.

FTC: We use income earning auto affiliate links. More.

![Long delays with cash withdrawals are causing some Apple savings account users to flee [Update]](https://www.blackbikertv.com/wp-content/uploads/2023/06/36455-long-delays-with-cash-withdrawals-are-causing-some-apple-savings-account-users-to-flee-update-1200x500.jpg)