New market intelligence data suggests that the Apple Watch has seen its best ever Q3 shipments, up 7% year-on-year. The latest Apple Watch SE was credited with contributing “significantly” to that growth.

The biggest winner was Huawei, which this year emerged as a major player in the premium smartwatch market, taking many of its sales from Samsung …

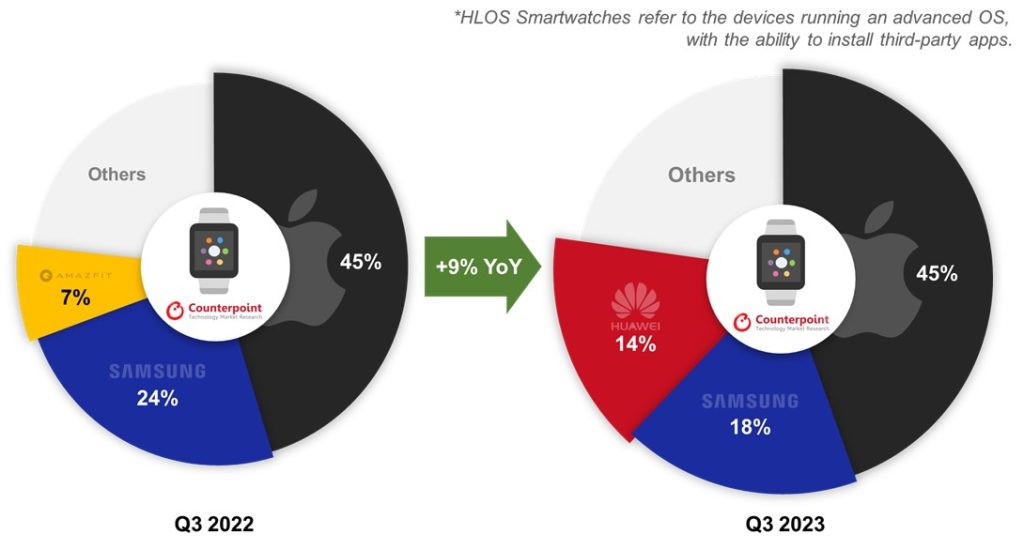

Counterpoint research shared its data for the premium smartwatch market, which it defines as watches capable of running third-party apps. The firm labels these as High-level Operating System (HLOS) smartwatches.

Apple Watch

Apple delivered its best-ever Q3 performance, with a 7% YoY increase in shipments. This achievement is particularly noteworthy given that the latest Apple Watch, a key product in their lineup, was released slightly later than the previous year. The strong shipments of the 2nd-generation SE model significantly contributed to the growth of the industry leader.

That growth was actually slightly lower than the market as a whole, which grew by 9% in the same period.

Global smartwatch shipments increased 9% YoY in Q3 2023, according to Counterpoint Research’s latest Global Smartwatch Model Tracker. After experiencing a slowdown earlier this year, the smartwatch market regained momentum in Q2 2023 and continued the positive trend in Q3 as well. The primary drivers of this growth were the sustained strong performance of the Indian market led by Fire-Boltt, as well as Huawei’s tremendous rebound in China.

Huawei

Huawei was the standout, as the firm somehow bounced back from US chip sanctions which effectively wiped out the company from the smartphone market – and much of its smartwatch sales relied on bundles with its phones.

Huawei witnessed an impressive 56% YoY increase in overall shipments for the quarter, with HLOS smartwatches seeing a remarkable 122% surge. Its Watch 4 and 4 Pro series, released in Q2 2023, and the Watch GT 4, released in Q3 2023, have achieved good popularity. The increase in Huawei’s shipments was due to the return of its smartphones and the bundled sales model induced by various sales channels.

Samsung

While Samsung’s Galaxy Watch 6 Classic seems to be selling well, older products experienced a significant drop in demand.

Samsung experienced a 19% YoY decline in shipments. However, the new products released in August exhibited only a 3% drop compared to the previous ones. In essence, the decrease in Samsung smartwatch shipments this quarter appears to be primarily attributed to a sharper decline of legacy models. Meanwhile, the proportion of the Galaxy Watch 6 Classic significantly increased compared to last year’s 5 Pro, contributing to the rise in the ASP of the brand.

Photo: Alexandru Tabusca/Unsplash

Add 9to5Mac to your Google News feed.

FTC: We use income earning auto affiliate links. More.