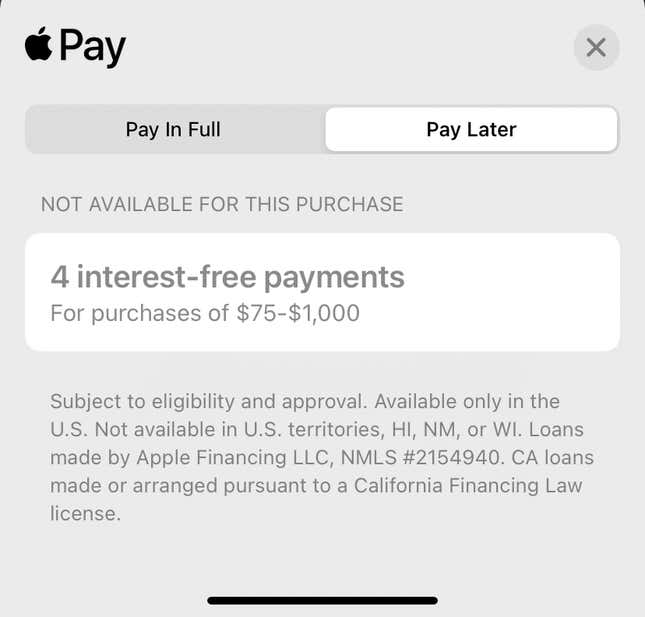

Apple Pay Later officially launched for all qualifying U.S. residents today, and is now available in the Wallet app on the iPhone, as first reported by MacRumors Tuesday. Users will now have the option to pay for purchases between $75 and $1,000 in four payments over six weeks with no interest, fees, or impact on their credit.

Buy Now or Wait? How to Avoid Tech Buyer’s Remorse

The feature was previously available on an invite-only, early-access basis since March. Apple’s original announcement of Pay Later originally had the minimum purchase at $50, but tests by Gizmodo saw the new minimum at $75.

Apple did not immediately respond to Gizmodo’s request for comment.

Users can use Pay Later by making a purchase and selecting Apple Pay as their payment method. A second option now appears for Pay Later, which will include details of the payment plan based on the price of your initial purchase. These payments, unlike the Apple Card, will not accrue interest.

Apple provides the liquidity in Pay Later services, unlike the Apple Card which is backed by Goldman Sachs. Bloomberg reported last year that a subsidiary owned by Apple, Apple Finance LLC, will handle the lending for the “buy now, pay later” division. Though Apple customers may be used to receiving credit through Apple, this is an entirely new ball game for the tech giant.

Pay Later still works through the Mastercard Installments program with Goldman Sachs as the issuer of payment credentials, according to Apple. Goldman’s partnership with Apple recently came under fire internally when it was reported a partner at the Wall Street giant told colleagues that “we should have never done this f—ing thing.”

Apple’s Vice President of Apple Pay and Apple Wallet Jennifer Bailey says “Pay Later was designed with our users’ financial health in mind.” However, using ‘buy now, pay later’ apps like Klarna and Affirm are hardly seen as smart financial decisions. A quarter of ‘buy now, pay later’ users miss payments, and 41% of users carry debt from the service, according to a Morning Consult study. Nevertheless, the services are widely popular, with 1 in 5 U.S. adults using them.